Perspectives on risks to local markets and industries

Research by CSIRO’s Gas Industry Social and Environmental Research Alliance (GISERA) has provided new insight into the different factors consumers take into account when making purchasing decisions.

The project, which was undertaken in response to stakeholder concerns that ‘clean, green’ regional brands may be put at risk by natural gas development, involved industry engagement and a survey of Australian consumers. CSIRO conducted this study in partnership with the University of Adelaide’s Centre for Global Food and Resources.

Results revealed that concerns about the environment, energy and resource development do not rank as highly as price or food quality in consumer purchasing decisions.

“Previous GISERA studies have indicated some community and industry concern that natural gas development may pose a risk to food and beverage markets,” says Dr Neil Huth, a CSIRO Research Scientist whose work focuses on farming systems. “What this study shows is that even among consumers who see themselves as environmentally and ethically conscious, when it comes to making decisions about what to buy those decisions are based more on the cost and the quality of the produce.”

The importance of regional branding

The value of Australia’s agriculture, viticulture and livestock is strongly tied to the perception of Australia as a country of well-managed land, clean water, and fresh produce.

“There is a high level of trust in Australian production processes,” says Dr Huth. “It’s not that consumers are parochial in their purchasing decisions; but if an Australian product is labelled with something like ‘pesticide free’ or ‘carbon neutral’ – some attribute that aligns with a consumer’s values – then people feel they can trust that.”

Many food and beverage producing regions across the country have developed their own distinct branding that builds on this perception of trustworthiness. These regional brands, which include Tasmania, Hunter Valley, and Yarra Valley, have high levels of recognition with Australian consumers and allow businesses to add value to their products.

In regions where there is the potential for future gas development, some primary industry stakeholders have raised concerns that the value of their regional brand may be at risk from gas development. The recent GISERA research project tries to address that concern.

hay bales South Australia

Hay bales South Australia

A national survey of consumers

To gain a better understanding of the factors that influence purchasing decisions – and to quantify the value placed on regional branding and associated attributes – CSIRO researchers undertook a broad survey of potential consumers within the Australian domestic market.

“The survey was designed to get as representative a sample of people as possible,” says Dr Huth. “Looking at people who make purchasing decisions, we set quotas for gender, age, and location to try and obtain a sample that closely matches the characteristics of the general Australian population.”

Responses to the survey, which took place online in late 2021, enabled researchers to collect information about the associations consumers make between different Australian regions and their industries, agricultural products, and regional attributes. Researchers then subjected the resulting data to numerical and graphical analysis.

What were the key findings?

Survey respondents were asked about their preferences and personal beliefs regarding different aspects of food production and environmental values.

Using a response scale from strongly disagree (-3) to strongly agree (+3), respondents indicated the extent to which they agreed or disagreed with a range of statements relating to food quality, food safety, place of production, animal welfare, and carbon footprint.

Results showed that even though consumers generally regard themselves as environmentally conscious, ethical and environmental factors – including concerns about resource or energy development – rank much lower than price and food quality in purchasing decisions.

“Consumers state that they have concerns about many issues, including contaminants, pesticides and animal welfare,” says Dr Huth. “But the three most important factors they take into consideration when making purchasing decisions are price, quality, and country of origin.”

In a list of sixteen potential concerns about food production, the top six all related to food safety. Concerns relating to place of production and animal welfare were ranked next, and concerns about mining and energy industries within food producing regions were ranked 13th-16th.

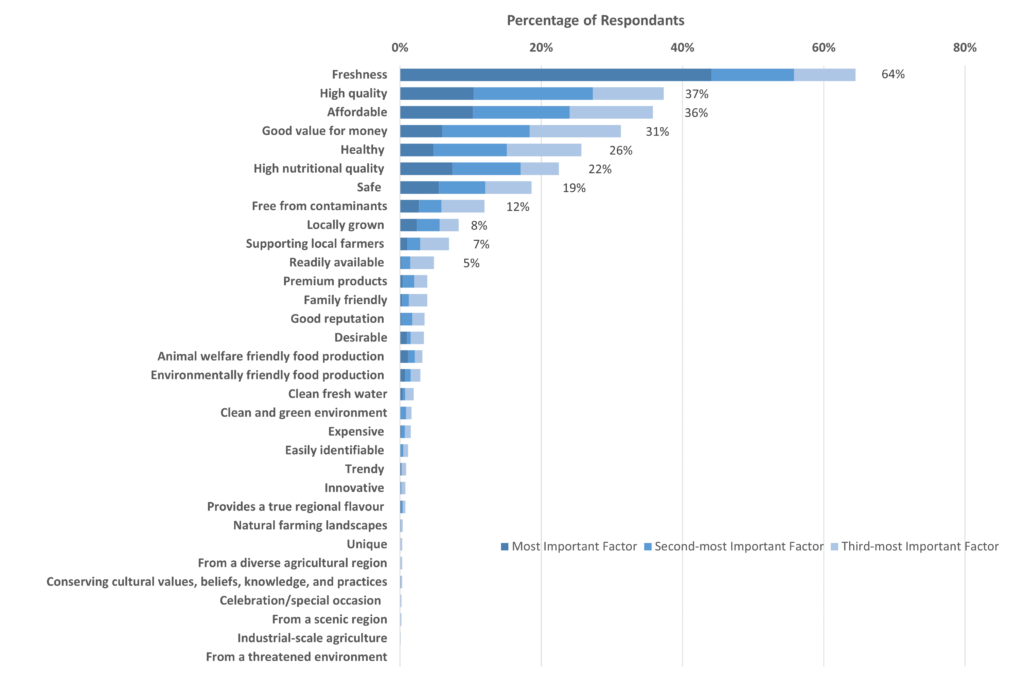

CSIRO’s GISERA perspectives on risk to local markets – factors influencing purchase decisions

Factors influencing purchase decisions, ranked in order of importance.

Respondents were also asked about their awareness of different Australian food producing regions, some of which are regions where resource development has taken place. The survey results revealed that perceptions about products or attributes of a region can be strongly affected by proximity to the region.

While consumers may hold some concerns regarding gas or mining activities, the results of this study do not suggest that most survey respondents associate specific products with regions, or specific regions with energy or resource development.

“When you look at the associations people make between a region and its attributes or products, there are not many that come out above or below average,” says Dr Huth. “Tasmania comes out highly for seafood and lobster production, but surprisingly it came out with a below-average association for wine. When you drill down into the data, there are not always many clear associations at all.”

“It was interesting to note in the survey results that Hunter Valley – which is known for industry and mining – demonstrated a valuable regional brand, with high desirability of food and beverage products. This is an encouraging example of an established regional brand persisting while resource development is undertaken in that region.”

A question of trust

Previous research has identified the role of external influencers, including governments, advocacy groups and mass media, in affecting consumer trust in food products, and Dr Huth believes that the issue of trust is key to assisting community understanding and informing public communications and policy development going forward.

“There are a lot of complex processes at play, but what we find when we unpack why people buy things is that there are preferences for local production as a surrogate for quality,” he says. “Consumers place trust in frameworks – regional production systems, quality assurance processes, governments and industry – and anything that impacts those will lead to a loss of trust. By gaining a better understanding of the mechanisms by which trust is built or lost, we can assist with developing pathways for mitigating risk to regional brands. It’s an area with lots of potential to investigate in future research.”

Read the final report Perspectives on risk to local markets and industries